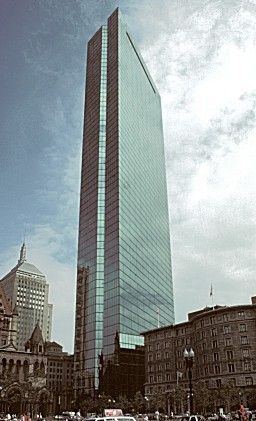

The John Hancock Building will be sold at auction today after the owner, Broadway Partners, defaulted on its mortgage debt.

Broadway just bought the building in ’06 for $1.3b but can’t secure a refi so the lender, acting very quickly, is dumping the behemoth on the Boston commercial real estate market.

They might get $700mm for it, they might get less. In-any-case this is a sign of incredible stress in the commercial real estate industry.

You can read more at boston.com.

UPDATE: The tower sold for a ~$660mm to a partnership between Normandy Real Estate & 5 Mile Capital. Details in The Wall Street Journal.

——————————————————————————————–

You can apply for a commercial mortgage loan online at MasterPlan Capital.